Always believe in… Gold

Photo by Felipe Simo on Unsplash

As most of our readers know by now, we’re keen watchers of market narratives and firm believers in the power of narratives to drive mass behaviour and, as a result, asset prices.

The past week has undoubtedly been a textbook example of how the development of a global macroeconomic narrative works the levers of asset prices, with the US assassination of two senior Iranian military figures potentially precipitating what some predicted could become World War 3. No wonder that Gold managed to re-take 5 year highs, as everyone went risk-off.

What a terrible, inane opening paragraph that would’ve made for. And perhaps an even more boring newsletter. If you’re looking for a real trick of financial engineering in the metals space, check out how the Chinese did it.

The part about us being keen watchers of market narrative is true, but we would hardly be insightful going down that path. For one, if you think that Gold reaching 5 year highs this week is a function of a missile strike in Iran, think again – this rally was at least two years in the making.

This is a story about narratives within narratives, and about how they came to matter so much for markets.

Character building

To tell a story, we need characters. Some characters are more dynamic than others: they evolve, interact with other characters and, over time, take on new shapes and forms. They make for interesting subjects of scrutiny, but variation in character traits makes them complex creatures to analyse over time.

In our case, we need a character which has been fully developed: matured, well-known and invariant, with a clear role to play in the story and a singular purpose and direction. Since we are telling a story about the story, at the very least our main character must be constant.

And what better choice than Gold itself: from ancient Egypt to the Crusades to the present day, notwithstanding the dismantling of the Gold Standard, Gold is the indisputable constant. The cash among all cash, the ultimate store of value.

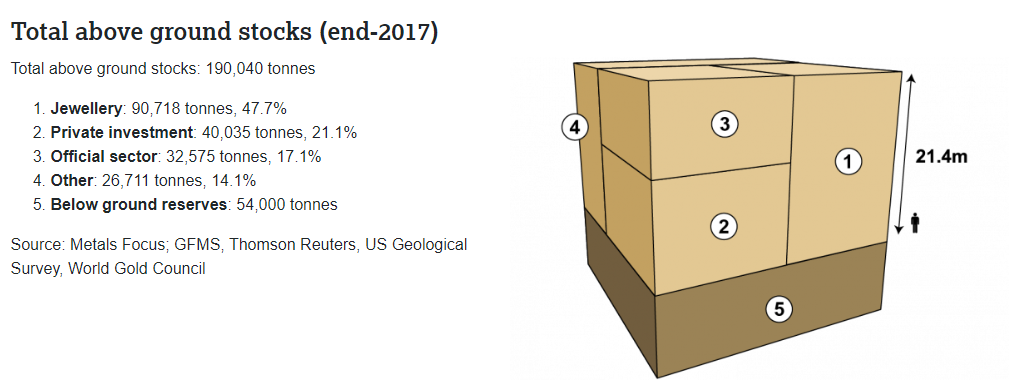

Of course, Gold has had many uses over the centuries and millennia, and being effectively indestructible (who would want to destroy gold anyway?), all the gold that has been mined throughout history is still lying around. The World Gold Council estimates that of the 190k tonnes of Gold that has been mined throughout all of history, two-thirds of that has been mined since 1950.

Data from the World Gold Council also indicates that while around 52% of total annual gold demand comes from Jewellery, only 3% of total demand is absorbed by ETFs and other financial products, and a further 8% by central banks.

In contrast, total tonnage of gold traded (both on exchange and over the counter) amounts to about 63% of total annual demand. So while the actual use of gold is largely cosmetic and in jewellery, the price of gold is effectively determined by speculators. Not demand and supply from jewellers and industry, nor a result of management missteps. No individuals here, just pure, unadulterated mass sentiment.

And that makes gold an excellent barometer of market sentiment, and our top choice of lead character in this ongoing tale.

So what’s the story?

As our news alerts and headlines get dominated by the happenings in Iran and Iraq, and the belligerent pronouncements from the White House and Tehran vacillate between posturing and actually pressing one red button or another, it is easy to conclude that the gold “spike” was a consequence of all of this. And sure, for a day or two it was, but that hides a longer story that has been brewing for quite a while.

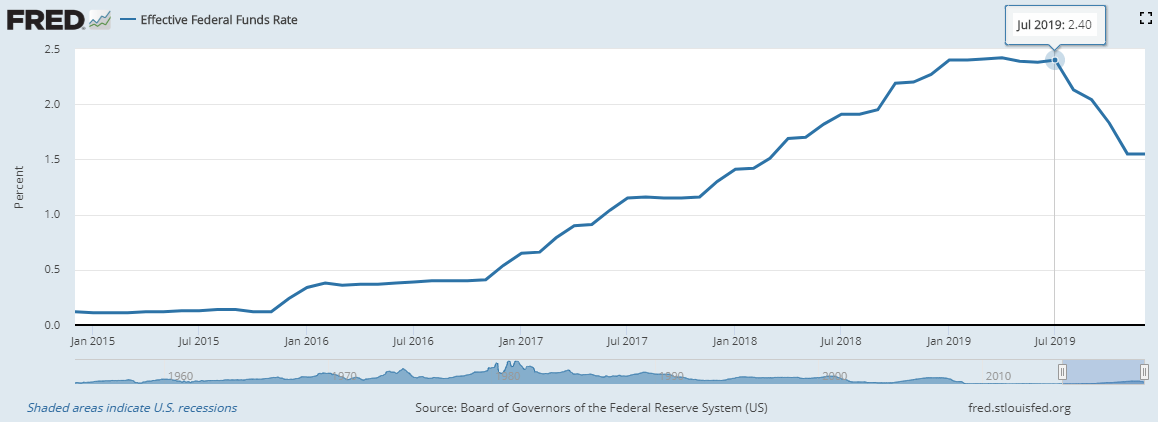

The charts tell a different story: Gold found a bottom at the end of 2015, but continued to largely trade in a range for the years following that. But something changed mid 2019, when gold started a move that broke the 6 year trading range.

No assassinations, no declarations of war, no invasions. Just a change in direction – in the Fed’s interest rate policy. Mid 2019 was when the rate hikes stopped:

A couple of months later, we saw the beginning of what became known as “#NotQE” in the Twittersphere, as the New York Fed started dishing out liquidity into the banking system via repos:

Source: Federal Reserve

After taking a month or so to work out what exactly was going on, Gold continued its climb from the c. $1450 level in Nov 2019, all the way to this week’s spike.

When someone pays cash to buy gold, that asset that really isn’t good for anything other than being shiny, rare and hopefully storing value, delivering zero yield, they’re looking to get out of whatever it is they are in.

The right narrative, not the obvious one.

When we think about market narratives, we think about different groups of people screaming their version of reality. The ones that are most coordinated and scream the loudest are heard, and as others come round to their view, their version of reality takes over as the dominant narrative – giving reason and explanation to what seems to be happening.

In this case, we needed a reference point that could not be influenced in too many ways, with limited scope of movement. Gold almost only moves in response to speculative demand: often this is seen as the inverse of risk-taking, the ultimate “move to cash”, when “fear” overtakes “greed”.

Is this move really a “risk-off” move? A cross-check with the Japanese Yen, another common “risk-off” asset, which was in fact weakening against the USD over the last quarter of 2019, suggests that investors were seeking more risk, rather than less, at the same time gold was staging its climb.

If we were to hazard a guess, we’d point to a growing school of thought that the fiat monetary system which came into being after the Gold Standard was dismantled is facing growing dysfunction.

Many market observers have written about this, from the likes of former head of the BIS’ Monetary and Economic Department, William White, (his piece on “Fault Lines in the Pursuit of Financial Stability” is worth a read) to our favourite read, Epsilon Theory, by Ben Hunt. Theories vary as to how the great monetary experiment will end, or if it ever will.

The risk is inflation, and while we haven’t seen inflation in common consumer price indices, the pace of asset price growth – from real estate to stocks – is as inflationary as you’d get.

Perhaps it is exactly the suspicion that the great monetary experiment will never end that is driving demand for gold. For gold, being the ultimate form of cash, can do the one thing no fiat currency can do – maintain its real value in an inflationary environment.

Exit Stage Right Stay Put!

If those were the initial stage directions for the QE script, recent policy has categorically put a line through them. While the old adages that “The Fed is your friend” and “Don’t fight the Fed” continue to hold true, it is also too easy for investors to point the finger at policymakers and the Fed when it comes to apportioning blame for poor performance and supposedly nonsensical markets.

We forget that this wasn’t part of the plan. And perhaps we – the market – are as responsible for what has transpired. After all, it was the market which threw its infamous “Taper Tantrum” in 2013 when the Fed first tried normalisation. It was also the market that staged huge rallies when easy money came along.

Perhaps the Fed took the rule of thumb the other way round: “Don’t fight the market.”

While putting together the data for this piece, we came across former Fed Chairman Ben Bernanke’s testimony to the Committee on Financial Services in Feb 2010, laying out the Federal Reserve’s exit strategy from what he called the “the extraordinary lending and monetary policies that it implemented to combat the financial crisis and support economic activity.”

The rationale was simple:

“In due course, however, as the expansion matures the Federal Reserve will need to begin to tighten monetary conditions to prevent the development of inflationary pressures. The Federal Reserve has a number of tools that will enable it to firm the stance of policy at the appropriate time.”

From raising rates on bank reserves to draining liquidity via reverse repos to offering term deposits to redeeming securities, Chairman Bernanke had articulated in 2010 a plan to reverse the extraordinary monetary policy and normalise the monetary system.

Thus he concluded:

“The economy continues to require the support of accommodative monetary policies. However, we have been working to ensure that we have the tools to reverse, at the appropriate time, the currently very high degree of monetary stimulus. We have full confidence that, when the time comes, we will be ready to do so.”

Chairman Bernanke called it. Inflation.

When the narrative isn’t the narrative

As always, we’re the first to admit that when it comes to telling the future from peering into a crystal ball, we’re not experts and most of the time our macro predictions are unreliable. We aim to think of potential outcomes and be guided by markets as the outcomes unfold. The risk with pinning one’s mast onto a prevailing narrative is that it shifts so fast and backing the wrong narrative with too much conviction can lead to trouble.

The real game in town here is what the slow rise in the gold price is telling us, not the spike. And it’s telling us that dreaded “inflation” may be lurking around the corner, far closer than the narrative may suggest. But more on that another time (soon).