What are emerging opportunities?

Photo by Javier Allegue Barros on Unsplash

As you have seen from our newsletters, we read, listen, watch and create a lot of stuff. Some of it is pure fun, and some is very serious.

Our interests are a function of our individual personalities and as such, they come from a wide variety of different places. We firmly believe that the wider and more disparate our interests (the more general they are, so to speak) the better equipped we’ll be to handle the plethora of information that’s constantly bombarded at us. Casting a wide net allows us to connect the dots, generate good ideas and execute them properly.

What gets you excited to wake up every morning? For anyone with a genuine sense of curiosity, there can never be enough hours in the day to explore what it is that fascinates us. We’re fortunate to be in a position to merge what we do for a living with our own personal interests every single day. That’s why we’ve built this business the way we have. Every day the world hands us ideas (good ones and bad ones), as things change all the time. Old stories die and new ones are born, and our task is to happily sift through them, relishing every moment.

As most of our readers will know, our background as an investment management team is in emerging markets. We were attracted to these markets partly as a function of personal history, but partly because they are just so alluring. Who wouldn't be seduced by Vladimir Putin on horseback, or Recep Tayyip Erdogan bouncing along to his own song being sung at him by thousands of adoring fans? We’ve been extremely fortunate to have seen a lot in our time. Our travels have taken us from Norilsk’s grim permafrost to the glory of a summer evening on the Bosphorus; from scorching hot rural Indian dust bowls to dirty urban sprawl (in many places); we have almost seen it all. But as wonderful as these experiences have been, as we look ahead from an investment management perspective we do not believe that the term or category “emerging markets” is relevant to the world as it stands today.

There are a multitude of reasons for this belief, as per our prior musings. That certainly doesn't mean there are not individual opportunities out there (there are loads) – it simply means the blanket approach to emerging market investing is probably gone forever.

The end of the story.

Before we begin our story of emerging opportunities, let us cast our minds all the way back to a time when emerging markets were full of appeal. Instead of going into the macroeconomic drivers at the time, let’s rather focus on the stories that were told.

Emerging markets were about growth! There was this enormous, untapped pool of opportunity in a world where only the bravest souls had previously ventured. Imagine all those consumers getting richer and buying the things that those in the developed world already took for granted. These countries would converge to developed standards!

Remember the famous story about how much toothpaste would be sold in India if a billion more people just brushed their teeth not twice a day, but just once? Or how the traffic jams in Jakarta were a healthy sign of how much richer the consumers were getting? How about the Chinese supercycle and its stratospheric effect on commodity prices for over a decade?

We used to tell the true story of our nanny in South Africa growing up. She was in tears when her son came home with his first car – which also happened to be the first car anyone in the history of their family had ever owned. He had just secured his first job after graduating from university (also a first in her family).

These stories are very powerful. And what sold emerging markets as a group were the stories that fed the imaginations of investors worldwide. And boy, was the story of emerging markets a riveting one. Full of macro twists and geopolitical turns, and to a large degree much of what was promised did indeed come to fruition. But all great tales come to an end, and the story of emerging markets as a group is no exception.

A very wide net.

But guess what? Stories are not unique to emerging markets. Once the world was done with emerging markets, it was tech and the internet and how billions of consumers worldwide would flock to buy everything online and share their lives with others, amongst other things. There was a time when tech was an emerging opportunity. Maybe it still is.

The point is that these opportunities come and go and there is no rule as to where they come from. Opportunity isn’t selective and one needs a very wide net to find it. The key is to identify these trends relatively early and not be too greedy so you ride them all the way down again too or get wiped out along the way. How many investors held Amazon through its 90% drawdown during the tech bubble anyway? And does it even matter now if you did?

Our focus is on a number of emerging opportunities at this time. We believe that our multi-asset mandate gives us the best chance of capturing these opportunities wherever they may be. Here’s a sample of some of the ideas we are excited about (in no particular order).

1. Gaming in an age of competition for time and attention

Gaming continues its rise as a form of entertainment in the arena of competing for our time and attention. The new champions will not be the old ones. Companies like CD Projekt and other smaller, nimbler studios lead the charge against the falling giants, Activision Blizzard, Electronic Arts, and some could argue even TakeTwo Interactive. However, they may all soon be challenged by the emergence of the metaverse (anyone read Snow Crash or seen Ready Player One?).

This is a generational opportunity, however at this early stage the key contenders are all privately held or part of a far bigger machine – Fortnite, owned by Epic Games (private/Tencent), Roblox (private) and Minecraft (private/Microsoft). These platforms are eating up the time and attention of young adults and they will grow up with them as both the youngsters and the platforms evolve and mature.

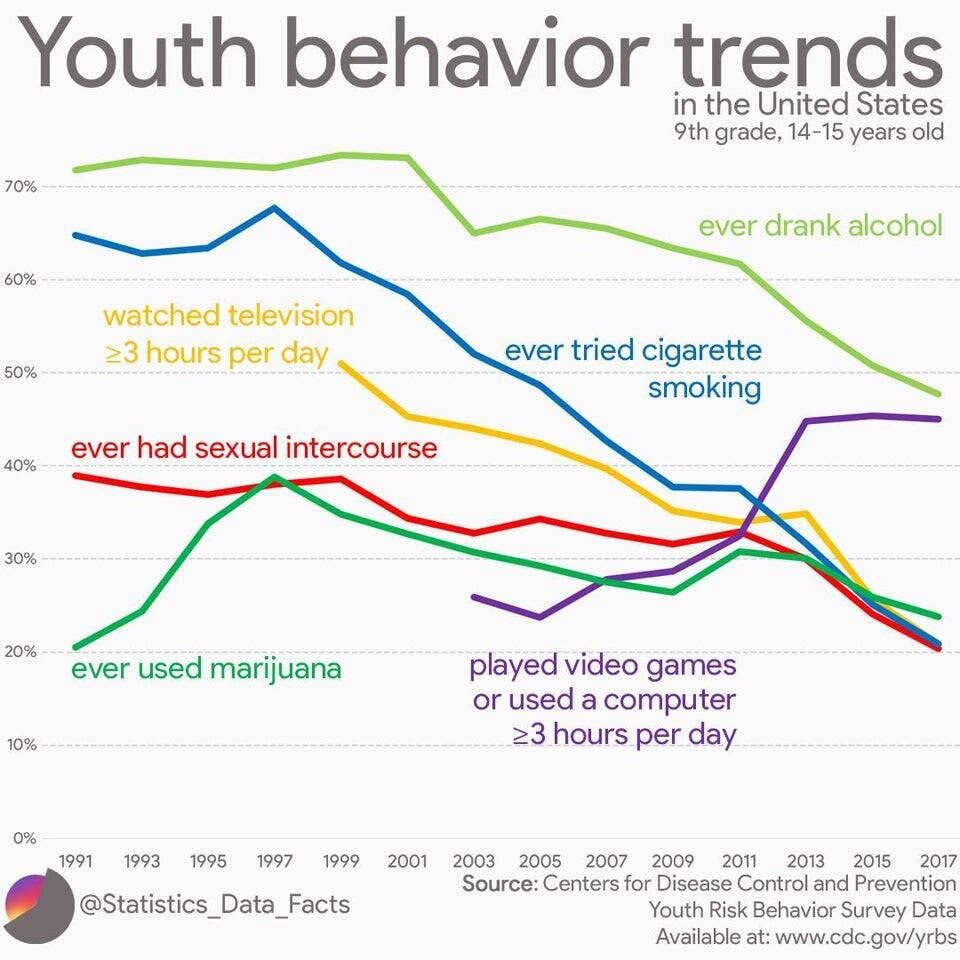

This goes all the way to a discussion on the future of work and it is conceivable that one day work may take place inside the metaverse – but that is another discussion altogether. The competition for our time and attention is happening across sectors. Television competes with gaming, which competes with sport and exercise. The list goes on. A recent study showed that young adults prefer gaming to pretty much everything including sex, drugs, tobacco and alcohol (and more mundanely, television)!

For more on this emerging opportunity refer to our post on gaming written early last year (a lot has changed since then too!). Needless to say there is no absence of opportunities, long or short, in this space.#

2. Digital finance? Or decentralised finance?

It is inevitable that we see the disruption of traditional financial services. This threatened to happen with the rise of nimbler fintech operators, but despite much acclaim and lots of successful funding rounds, we believe that these fintech companies are simply reinventing the wheel. Sure, it's more convenient to have a cool app, but they are piggy-backing on the exact same set of archaic infrastructure as the “dinosaurs” they seek to displace. In other words, the revolution cannot be a front-end phenomenon. True change begins with the back-end.

Our key interest here is in the DeFi (decentralised finance) space. Built purely on code and a system of self-correction that relies on participants seeking arbitrage opportunities, DeFi platforms have started to take impressive form. No longer are these the preserve of “crypto nerds'' who are just tinkering with trading of tokens: DeFi applications like Compound (permissionless collateralisation of non-fungible asset e.g. invoice factoring), Maker (permissionless lending) , Uniswap and Kyber (decentralised exchanges) and Synthetix (permissionless synthetic leveraged trading) are emerging fast. All of these applications run with no centralised decision-makers: no loan officers, no board approval, just a clear set of algorithms and criteria. When thinking about these one shouldn't think in terms of developed markets with well established, archaic infrastructure (although we believe in time the threat is there too), but rather, the unbanked (and even the banked) in places where the needs of the public are not being properly met.

At the heart of all of it is Ether, Ethereum’s digital currency. Ethereum is an open source, public, blockchain-based distributed computing platform and operating system featuring smart contract functionality. Every transaction on the Ethereum blockchain is fuelled by Ether, its native digital currency or “gas”. Fees and transaction costs need to be paid to the network of connected computing notes that is the Ethereum network, and all of these are paid in Ether, literally making it the lifeblood of the decentralised finance complex. In short, every single time a transaction unfolds on any of the mushrooming DeFi platforms based upon Ethereum, Ether must be paid.

We must state very clearly that this ecosystem is in its infancy, and as such it is still experimental, but progress is at light speed and the system is a complete re plumbing of finance as we know it. The direction of travel is clear. Everything from lending to insurance, to savings products is being reimagined as we speak. The opportunity here is both long and short as incumbents struggle to adapt to this new threat.

3. Climate change and the environment

As politicians continue to respond to the needs of younger voters (who get older and more relevant) as society evolves (refer to this Tim Urban piece on how political shifts reflect the demands of the people over time), the regulatory guillotine falls on many crude oil, palm oil and plastics businesses to the benefit of cleaner technologies. Power generation will also shift away from dirty fuels like coal over time too (yes, even in China).

Key sub categories include (amongst others)

Crude oil – 2020 appears to be the first year where mass market electric vehicles are being released by the bucket load from all the global established majors. As governments ramp up regulation, auto producers will ramp up electric capacity. And consumers are ready and willing. China is working towards a full ban of petrol and diesel cars in 2030, the UK announced earlier this year a similar ban by 2032 or 2035, and Norway will do it first by 2025. The only real question is when will the United States do the same? Given the ongoing demographic changes in the voter base, it can’t be long before politicians announce a target date for going fully electric. This will surely present major challenges for countries whose economies have been driven by oil prices and a boon for other countries who import crude oil. Further, global automotive producers who are unable to shift their production to electrical vehicles profitably also present an interesting short opportunity. And even if they can, they will most likely have to compete with Chinese producers who are backed by the government, with no real profit prerogative in order to reach their 2030 target.

Palm oil – Europe has already banned the import of palm oil and global incremental demand is slowing with the price moving accordingly. Producers in Indonesia and Malaysia should remain under pressure as it is hard to see where the incremental demand may come from.

Plastics – Single use plastics are already banned in Europe, with a ban pending in the UK and extreme lobbying against in the USA (with some city-wide plastic bag bans already). China also has recently announced a plan to ban single use plastics. We see this as a large emerging opportunity given the already fragile nature of many of these chemical businesses in the global supply chain. At best, a booming global economy gives a small modicum of pricing improvement and given the onset of large new global supply, one could argue that even in the absence of structural headwinds, the outlook for many chemicals businesses is challenged. There are a multitude of emerging shorts here particularly in emerging markets where the political dynamics are unfavourable.

4. Real Artificial Intelligence

Much fanfare has been made about how AI is going to change our lives. Our view is rather more pragmatic – we look for how it will affect the earnings of companies. We also look for pure play emerging opportunities in this arena. Our research has led us to believe that China and the US will dominate (refer our piece on thematic opportunities written a year ago), but the search for individual opportunities is less straightforward.

While China may not be the flavour of the day at the moment, the fact that they are an AI superpower is not to be ignored, whether or not the rest of the world would like to admit it. The ability for the Chinese government to collect, aggregate and process data across its country and the entire population is simultaneously a nightmare for privacy proponents and a dream come true for machine learning researchers.

Within the listed space, the trifecta of “BAT” (Baidu, Alibaba and Tencent) are well-known as also being the “AI Champions” of China. But these are also offshore-listed entities, with large foreign shareholdings subject to at least some degree of foreign scrutiny – not ideal for housing strategic interests. iFlytek is the lesser-known fourth AI champion: listed in the domestic A-share market, with a significant minority position owned by state-owned entities like China Mobile and the University of Science and Technology, iFlytek has been awarded AI voice recognition and data processing contracts in industries like law, public administration and education, sensitive sectors that are often the preserve of state-owned entities. This is but one example of this particular emerging opportunity.

5. Psychedelic Medicine

One further brief example for us to explore is that of psychedelic-based medicine, which only this week has seen its first two IPOs, both of which surged on day one. In an industry that has long been skeptical about chemical compounds like psilocybin (despite many decades of scientific research), recent favourable regulation and medical research has led to much promise that some of these compounds can do much good for psychological illnesses such as depression, addiction and PTSD. This example is really interesting because the idea arose out of pure personal interest and curiosity (no, we haven’t sampled any yet). We read a couple of books about consciousness and were drawn to this idea and upon further research it turned out to be an interesting investment idea!

There are many more ideas we can discuss all day and all night, and we hope that all these exciting opportunities have given you a bit of a flavour for where we are going to be hunting. Of course this is just the first step in our investment process – if you are keen to chat or hear more please get in touch with us and we would be delighted to debate some of these ideas or share more with you.