Weekend Reading #110

This is the hundred-and-tenth weekly edition of our newsletter, Weekend Reading, sent out on Saturday 20th March 2021.

To receive a copy each week directly into your inbox, sign up here.

*****

What we're doing.

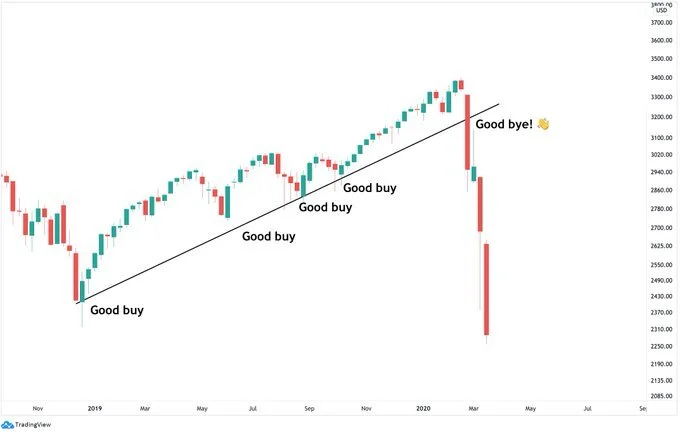

This week we have been trading in our fund. A lot. The volatility in the tech space provides excellent trading opportunities particularly on the short side. We also came across this chart on the Tradingview twitter handle which perfectly summarises what has unfolded in the tech space over the past few weeks, with a one-word message: "Reminder".

A buy the dip mentality has been forged in the market as everyone became a “tech” investor and the indiscriminate rise of almost anything labelled “tech” gave confidence to repeatedly buy the dip. But things do change.

There are a host of wonderful companies which present great long-term buying opportunities in this selloff but for each one of those there are dozens which got carried by the rising ride. Now that tide has gone out, we will soon see who gets caught without a swimsuit on.

In recent years, growth investing has been redefined as specialist “growth” investors have emerged out of the woodwork all over the place. Many of the metrics these investors use tend to focus on revenue rather than profitability. While revenue in an early-stage business is a great barometer of progress, it’s only so if one day (in the not-too-distant future) there is a high likelihood that profitability will follow. The problem is that almost every “tech” business has been evaluated in this way. Statistically speaking, very few will end up being profitable. When rates rise, we see how much belief there really is in those future cashflows! What's been fascinating to us is that despite the fall in the Nasdaq, the large cap champions (ie: those with proper businesses) have held up far better and we would not be surprised if the Amazons, Netflixes, Facebooks et al of the world lead the inevitable rally that comes once this is all over.

A return to better stock discrimination? That would be awesome, but we are as ever not sure how this all unfolds in the end and our fund risk exposure is kept extremely low. DC

What we're thinking.

More on markets and rates before we get into some of the other things. We think it is possible that the market isn't happy with the Fed. This week the Fed quadrupled down on the existing policy of no tightening for a LONG time in keeping with its market appeasement policy. The initial reaction was favourable although somewhat muted and thereafter the market rioted. While in the previous market regime, since the financial crisis, this has been EXACTLY what the market wants, today the market appears to want more comfort that the Fed will not let inflation get out of control. We can't know just yet whether we are shifting into an inflationary regime, but the signs are certainly there and most importantly the market is telling us that it is very worried. The last time that Fed was “behind the curve” was in 2008/9 when it did not ease quickly enough and the market rioted. This time the market may be telling the Fed it is behind the curve for not being more aggressive on tightening. It is possible that this move is not only about a “healthy” increase in bond yields as many would have us believe, but something more structural. Our base case is fast becoming the latter. Whether right or wrong, time will tell but we are not buying the dip just yet. DC

Away from markets and as parents ourselves, through our involvement with school in other parts of the world, we’re worrying about the impact of the pandemic on children, and the world economy of the future. Based off the educational deficits that were already materialising just 6 months in in September 2020, and looking at the estimates in this OECD report, considering that another 6 months have passed since, we are looking at the consequences of more than an entire year of operation, in a system that wasn’t working that well and equitably already. Having experienced in our own homes the requirements of even privileged zoom schooling in terms of time, financial investment in hardware, and educational / intellectual capability, it is clear that for all but the most privileged the impact would be severe. And data is emerging confirming this: In countries that have their year-end in December (the southern hemisphere) results are showing lower overall pass rates, in spite of severe political pressure to pass students. While official overall pass rates appear to be down by 5-10% in many countries the direct evidence we have some school in disadvantaged regions, in this case in South America, suggest a doubling and even tripling of fail rates. In the end, unless drastic measures are taken, which is unlikely, there will be a significant impact on future GDP. Arguably more importantly, this impact, in rich countries as in poor, will disproportionally hit the economically disadvantaged in all societies, which will increase inequalities and is likely to affect social stability. LM

What we're playing.

This week has been a busy one and gaming has somewhat taken a backseat over the past few evenings. On a couple of occasions though, we have briefly jumped onto DayZ to connect with our friends and fortify our base. Raids, whilst often needing much preparation, seem to be the most enjoyable part of playing, but as a casual player it is great to join in with teammates when the time comes to strike. This week, we raided a couple of well defended locations, with varying success. Nonetheless, the loot was bountiful and provided much needed supplies to progress as a character. As opposed to playing the games default servers, I have found that the community hosted servers are much more enjoyable, there are often discord channels for users to communicate more efficiently, dedicated traders and a series of settings adjustments to make the gameplay more fluid. Taking a step back, it is fascinating to see the bustling micro-economy that exists and the interaction between community generated currencies versus real cash inflows. HS

What we're reading.

This brilliant feature piece in Wired Magazine on Chen Qiufan is worth a proper read. As our busines is named after Liu Cixin’s Three Body Problem trilogy its no secret we are fans of Chinese Sci-Fi. Chen Qiufan is no less famous in China and has had a storied series of successes at the ripe old age of 40 (this year) and this piece digs into his history, his ideas and a weaves it together with the evolution of China’s science fiction scene. His debut novel, The Waste Tide is now at the top of our reading list. DC

If, like me, you’ve been cooped up in a city for far too long and you’re longing for a bit of countryside, Wilding by Isabella Tree is a fantastic read that, through the magical medium of the pages of a book, transports you, the lucky reader, to rural England where grass, mud, animals and all the rest are virtually placed under your feet. Wilding is a story about Knepp, an estate in Sussex that has for centuries been farmed using conventional methods. That was until 2000 when the book’s author, Isabella Tree, made the decision to return the estate to nature. This book looks at this fascinating process, which involved Tree’s family taking a step back from what has long been accepted and practised in modern farming. It meant, largely, a hands-off approach to farming and embracing of a return to nature in the truest sense. The book focuses on the challenges Tree and her family had to overcome upon taking this extraordinary decision and what she's faced in the last 20 years. It explores the bureaucracy of modern farming, the true meaning of biodiversity, provides a deep dive into many species that populate our green and pleasant lands such as deer, beaver, badger, and fox, and explores the extraordinary backlash that they faced from the farming community when they began their project. A deeply personal tale that is beautifully told, Wilding is inspirational in many ways and reminds us of the important role that nature plays and why we shouldn't accept the status quo in any aspect of our lives. Just like Tree and her family, we should question all traditions and conventions, however old, however entrenched. EJP

Readers will know that over the past month or so we have mentioned a number of articles and podcast links related to a pseudonymous NFT collector named Metakovan. Originally his B20 token caught our attention and then as the weeks went by it culminated in his record purchase of Beeple’s Everydays at the record Christies auction last week. This week saw some controversy as he revealed his true identity in a blogpost which is an incredible illustration of the democratisation of access that crypto brings. Our own blogpost this week covers what we call the democratisation of access and we hope you enjoy reading it. We would love to discuss with you further! DC

What we're watching.

Ah, television. Dear television. Our saviour for the past year of evenings. And they say we're living in a golden age of television and at TBC we agree, as you can no doubt tell from the swathes of high-calibre recommendations we’ve made for your viewing pleasure over the past 2 years or so. However, there is a nagging sense, especially in our house, that we might be reaching a point of no return. Peak TV, if you like, where the quality of new shows being produced can’t keep pace with our rate of consumption. That was the fear, at least, until this week when we stumbled upon the novel idea of trying out a stack of shows that, wait for it... weren’t in English! No, we know it's not a novel idea. High-quality subtitled shows have been hugely popular in the UK for many years. But the international offerings on Netflix have offered up foreign language shows that have (pardon the vaccine pun) been a real shot in the arm of late, coming right at the point when we thought that the content cupboard was looking a little bare. In the last week we’ve started two French shows, the hilarious Call My Agent! and the fascinating thriller Lupin, both on Netflix, which have opened a whole new world of television watching. What's more, only partly understanding the dialogue, due to our A Level French being un peu poussiéreux, means we’ve really got to concentrate on the screen and read every subtitle. That means no phones allowed, which is a thoroughly novel occurrence and a very welcome one, indeed. EJP

Somewhat surprisingly and at the risk of damaging my reputation I’ll go out on a limb and recommend a series on Amazon Prime called Unreal. My wife roped me into watching it with her and it is pure fun! The show is about a fictitious “The Bachelor” type reality show and captures the shenanigans that go on behind the scenes between contestants as well as the production team. The level of manipulation is extraordinary, and one wonders if that’s how the real show gets put together too. Honestly just pure entertainment. Something completely out of my normal repertoire but highly enjoyable! DC

Let’s assume for a moment that a professional drummer has never heard Metallica’s Enter Sandman. Assuming that were true, this video of Larnel Lewis of Brooklyn-based fusion jazz band Snarky Puppy doing a replay of Enter Sandman with just one listen is an absolute joy to watch. More importantly, his message at the end: “you don’t have to put yourself in a box, you can learn about all the different styles and genres that exist in the world.” “At the end of the day, these music/styles/genres exist as an expression, as an opportunity from different parts of the world to sing their soul and to let you know how they’re feeling at that particular moment.” EL

What we're listening to.

There has been a lot of buzz about NFTs recently and everyone has fast become an expert. But amidst the cacophany of noise and “”educational” pieces out there, we came across this interview with Fred Ehrsam of Paradigm Ventures, who appeared on one of our favourite podcasts, Creator Economics. It is the most clear and sensible take we have seen so far on this nascent space. Our view on NFTs is that we are incredibly early in this. Speculative frenzies will come and go but this technology is the real deal and will change the world especially in the creator economy. DC

A small piece of musical happiness we stumbled upon this week was a cover of the classic 1992 hit from The Cure, Friday I’m in Love. The really great Phoebe Bridges pushed out a cover in a recent Spotify session and the slower, more sombre version of the upbeat, joyful original is a truly exciting take on the track. It’s amazing how covers can make a song seem completely different but also entirely the same when tempo especially is played with. The original has a great sound, an iconic freedom that sounds, if you listen hard enough, like the beginnings of a massive musical movement that came to be called Brit-pop. The Cure were a hugely popular but slightly odd band, pop/goth if you like. Their lead singer and writer Robert Smith tells the hilarious story about how, when he wrote Friday I’m In Love he became convinced that he had heard the chord progression somewhere before and, hence, grew paranoidly sure that he’d stolen the song from someone else. He knew it was great but he thought that it was so great that someone else had written it and he’d merely ripped it off. Over months he set about playing the track for everyone who would listen who each confirmed in turn that, no, they hadn’t heard it before and, yes, it was a bloody good track. Eventually, Smith relented, retired his paranoia and recorded the track with The Cure and a hit was born, one that the hugely talented Bridges has done masterfully well to reinvent in her own image. EJP

The recent talk of the town has been the story of inflation returning to our lives, after more than a decade of deflation driven by a host of factors, not least technological advancement and China’s emergence as an economic engine of the world. As the market narrative moves from a deflationary one to an inflationary one, the question we ask ourselves all the time is: “What could make this rotation reverse?”. Specifically, “How might deflation continue to occur?”. This podcast featuring Louis-Vincent Gave, whom many might know as one of the co-founders of Gavekal with his father Charles Gave, is food for thought. He discusses the case for deflation continuing vs inflation emerging as a permanent “new/old” state of affairs, and also spends some time discussing another angle we have been pondering: rising US rates AND a weakening USD. EL