Weekend Reading #163

Photo by Mahendra Kumar on Unsplash

This is the hundred-and-sixty-third weekly edition of our newsletter, Weekend Reading, sent out on Saturday 9th April 2022.

To receive a copy each week directly into your inbox, sign up here.

*****

What we're thinking.

The dramatic rally in markets that we saw post last month’s FOMC meeting seemed to come to an abrupt end this week, perhaps punctuated by the release of the minutes of that same meeting which pointed to a pace of quantitative tightening of US$95bn/month (of which $60bn in treasuries and $35bn in MBS) being considered as a reasonable cap. To be clear, these were minutes of a meeting that happened 3 weeks ago, and the conclusions from that meeting were announced and published upon its conclusion. Yet, the market seemed to be willing to offer itself a three-week period of denial – at least, that’s what seemed to be the story many told themselves: that the Fed would never allow markets to crash, that the Fed Put was still very much in play, that one “should not fight the Fed”.

Except what happens when the Fed changes direction? There is little question that the Fed – through its signalling, communication and even material actions – is moving to reverse the direction it had taken over the past decade in the face of rampant high inflation and (for the cynics) probably political pressure heading into mid-term elections. The problem, as was highlighted by Credit Suisse’s Zoltan Poszar last week, is that while you can easily hit a button to print money, you can’t print commodities and food. And it is precisely because of there being too much money chasing too few goods that the textbook definition of inflation is fulfilled.

Has the narrative flipped? Maybe, but there has probably not been a bigger discrepancy between the expectations of the bond markets vs the equity markets. Anecdotally, the “bond guys” have typically been right when opinions diverge – and it would make sense, since things need to be REALLY bad for bonds to be in trouble (I.e. actually looking at default risk, rather than just “making less money”, as in the case of equities). This tweet thread by Jim Bianco is worth a read, but this chart which he posts is worth highlighting, showing bonds having their WORST YTD drawdown in any complete year since the Bloomberg Global Aggregate Index started in 1990.

The equities world doesn’t seem to have got the memo. Or perhaps they got it and decided to ignore it.

Ultimately, “Don’t fight the Fed” probably remains the right strategy. But will the market be as willing to listen to that mantra when the Fed isn’t in the business of selling Puts anymore, but instead selling Calls on the market, and when it’s pulling liquidity out of the market rather than putting liquidity in?

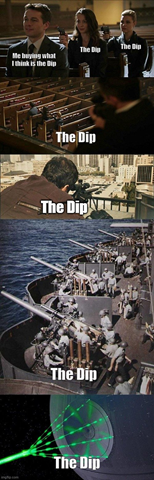

Old habits die hard, including “Buying the dip”, especially when they’ve had more than a decade to form. Here’s an old favourite from the Twitter archives:

What we're doing.

After 10 days in Cape Town and a wonderful time with family and friends it’s back to the U.K. this weekend. All week long I’ve heard stories of people emigrating and, for those who remain and run businesses, just how hard it is to do business here. Hopefully SA can get a boost from global commodity prices and maybe some kind of cyclical economic uplift but with 40% unemployment (officially) there is a very long way to go. That’s not to say the stock market can’t go up. As we have learned over the years the stock market can be very different from economic reality and with the Top 40 breaking more new highs this year, it seems global events are giving the market major tailwinds. Will it continue? Why not. DC

What we're reading.

A few excellent pieces out on Russia this week amongst the usual deluge of opinion. The first is an interview between Bruno Macaes and Sergey Karaganov. Karaganov is a former advisor to both Yeltsin and Putin and honorary chair of the Moscow think tank the Council for Foreign and Defence Policy. His thoughts and ideas are extremely influential on Russian foreign policy and in this frank conversation one gets a really good idea of what’s at stake from a Russian perspective as well as some revealing nuances into the psyche of the Russian decision makers at this point. Highly recommend reading this in which Macaes once again hits the nail on the head with his questioning.

The next piece I picked up from Dominic Cummings’ subscriber substack. It is written by a Russian lady named Farida Rustamova. She writes freely about what is going on n Russia. It is mostly in Russian but most posts are translated to English. This is an excellent piece of you want to understand why Putin remains so popular. And it’s not what you think. Rustamova paints a detailed and layered picture of what is going on inside the minds of key decision makers and also the everyday Russian. Again, highly recommend.

I also finished a brilliant fantasy book called The Poppy War by R.F Kuang which I’ve really enjoyed. It’s clearly based on a blend between a more modern (20th century) and ancient China and its history with Japan and is just so beautifully woven together. The main character is a young girl from the poorest province who drags herself up to somehow get entrance to the country’s most prestigious military academy where she discovers more about herself than she could ever have dreamed. I was once told by an experienced reader of fantasy books that you can tell the quality of a fantasy book by the quality of its map. The map at the front of this one is superb, and I constantly referred to it as I trundled along through the story. Blistering pace and one of the better ones I’ve read recently. DC

What we're watching.

With season 3 of the Amazon Prime Original series, The Boys, right around the corner. I finally finished season 2 and what a show it was! Despite being constantly subjected to the supposed “English” accent of New Zealander Karl Urban, the show was hilarious throughout with witty jokes, great action scenes and well-developed characters. Season 3 comes out on June 3rd so if you haven’t seen them, now is the time to get binging. HS

What we're listening to.

John Sweeney is a controversial journalist, previously of the BBC, now working independently from the front line in Kyiv. If you don’t follow him on Twitter, you should, as his on-the-ground reporting from the centre of the war has been one of the most informative and terrifying streams of news since it began. Sweeney is controversial because he takes risks, most notably when he posed as a “professor of mammothology” in order to confront Putin at a museum in Siberia about Malaysian Airlines flight MH17. Sweeney went to Kiev shortly before the war began so that he might be there when the action really kicked off – and if you ever need an anecdote to confirrm that war journalists are slightly crazy, there it is! Sweeney has just started putting out a podcast, titled Taking On Putin, and it’s a brilliant listen, a true reflection of what it’s like to be living on the front line of this conflict. The podcast aims to answer the question that everyone’s been asking and trying to find answers to since the war began – who could do this to Ukraine, to civilians, to children? Who is Putin? One man who can give a decent answer is John Sweeney – and that makes this podcast well worth a listen. EJP

During my run on the beautiful Sea Point promenade I listened to Lex Fridman chat to Karl Deisseroth, professor of bioengineering, psychiatry, and behavioural sciences at Stanford University. As with most conversations Lex does, the conversation meandered back and forth and covered everything under the sun but in chief it talks about the human mind and the problems that may arise when things go wrong. From depression to anxiety to decision making as well as some lessons from Deisseroth’s patients (he is a practicing psychiatrist. I am constantly amazed by the human mind and how it continues to mystify anyone who studies it to this date. As the two discuss in this conversation, despite the most cutting-edge data and analytics, no real new breakthroughs have been made with this abundance of data. Hopefully it will come! DC