Weekend Reading #327

This is the three-hundredth-and-twenty-seventh weekly edition of our newsletter, Weekend Reading, sent out on Saturday 9th August 2025.

To receive a copy each week directly into your inbox, sign up here.

*****

What we're thinking.

New highs for many market darlings this week. Did you know that Palantir is the best performing stock in the S&P500 both in 2024 and 2025 YTD? Can this continue? There are some signs of rotation but so far only a sniff. The dollar seems extremely weak and the Dow, the Russell 2000, traditional EM (incl China) et al are showing signs of wanting to lead. Sometimes with a rotation the leading part of the market (tech) sells off violently and sometimes it just keeps grinding up while the new leadership goes up more. We don’t know which one will happen, but our base case is for the latter. There are still many market participants who have not been involved in this rally, and they are coming! At the same time as we wrote last week, the price action is getting more and more aggressive so even though we are still positive as our base case all round, we do have an exit strategy should it all end earlier than we think.

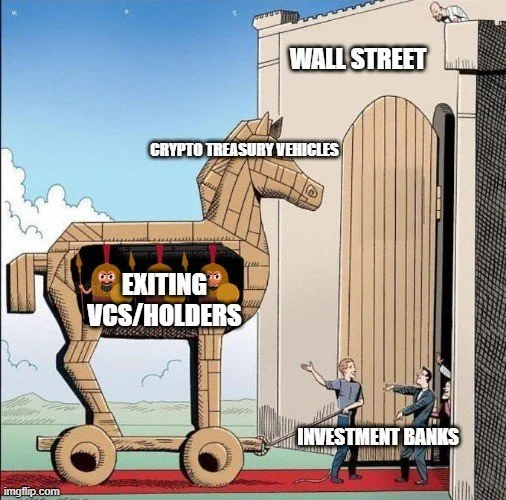

Our favourite topic this week is crypto treasury companies. Please don’t be fooled. Just think for a second why do these vehicles even need to exist? There are now lots of them. The first one was Microstrategy and in a way it made sense to do it. At the time, there was no Bitcoin ETF, and the argument was it is a great way for equity investors to express a view on Bitcoin. Then they started leveraging it up and just buying more and more. But that’s a different story. Nowadays not only is there a Bitcoin ETF but also an Ethereum one. So why on earth do we need crypto treasury companies? And indeed, why do they trade at premiums to the crypto they hold? Well, the first question is the real one. They are simply a very nice and efficient way for crypto bagholders to exit their crypto into a well recognised and efficiently structured vehicle often for cash without having to sell on the open market. Bitcoin can kinda still be made to sound logical, Ethereum also, but the tail is just pure grift. The copycat companies now being launched is pure memesis in action. Right now, crypto is going up and these things will probably go up. But they can do so without our money. We are absolutely salivating at the prospect of shorting the life out of these vehicles when the time is right. It’s not as far away as you think.

What we're meme-ing.

What we're reading.

I’d never read Stephen Pressfield before but have been meaning to read about Alexander the Great for ages. His historical fiction novel, Alexander: The Virtues of War, is an epic read. It’s different to many others as its written in the first person in a diary format and it is very effective. It brings to life the incredible military achievements of the man and indeed some of the softer parts of his character (hint: there were not many). DC

I had a conversation this week about Southeast Asia and a book entitled The ASEAN Miracle by Jeffrey Sng and Kishore Mahbubani was recommended. The gist of it is that ASEAN is a miracle in terms of its success in improving the lives of huge swathes of the population of Southeast Asia, a population of more than half a billion people. I managed to take a quick read through it and am only around halfway through, but so far, putting a cynic’s hat on, the book does seem more a defence of ASEAN as an organisation than anything else. Of course, it’ll be hard to prove the counterfactual: would Southeast Asia be the same without ASEAN? Perhaps, perhaps not, and the recent frictions between Thailand and Cambodia, both ASEAN members, seems to suggest that perhaps being part of a club does have its benefits, with members submitting to some degree of group discipline. Either way, it’s a fascinating thought, and all things considered, the demographic and economic fundamentals in Southeast Asia really do look compelling vis-à-vis the rest of the world. EL

What we're watching.

This clip from an account I’m sure most have seen, shows a bunch of rodents on a wheel. Now I’m not saying that hedge fund managers are rodents but most of the time we are like hamsters running on a wheel and I did have a laugh at my own expense while watching these creatures keep the wheel going round and round. DC

What we're listening to.

Tyler Cowen and Annie Jacobsen had a real conversation on his podcast. It was testy at times which was a lot of fun and made for great debate. The core topic at hand was nuclear weapons, what to do about them and what are the implications if used. This comes off the back of Jacobsen’s book Nuclear War, which I haven’t read but will do. The book apparently goes into infinite detail of how the world will end 72 minutes after detonation. And they also delve into many other juicy topics from her other books. Excellent listen! DC